Authors:

Melissa Levin, Vice President (Email)

Thierry Boveri, Senior Manager (Email)

Utility financial managers around the country are assessing the rapidly evolving conditions surrounding COVID-19 and questioning the implications it may have to their utility budgets and their fiscal position.

Performing a financial stress test and using your financial planning model to build a COVID-19 sensitivity dashboard can help prioritize your spending and establish policies for continuing service. Raftelis clients like Fairfax County, Virginia and Raleigh, North Carolina are finding that these tools can help decision-makers assess potentially rapidly changing variables.

Step 1: Identify Your Bookend Assumptions

Knowing the impact that COVID-19 will have on utility finances requires defining a range of assumptions from likely worst-case to likely best-case scenarios. Questions to consider when developing scenarios for consideration are how long are these conditions expected to persist and how significantly will the utility be effected? For example, we may assume for a probable worst-case scenario that current conditions may persist with a slow recovery spanning into 2021. Alternatively, we can examine a scenario in which we see an improvement by the end of summer with a return to normal by the start of 2021. In any case, projections should continue to be updated as conditions change to ensure planning assumptions are adequate and the utility can continue to fund operations. Step 2 is intended to help assess how significantly the utility may be effected.

Step 2: Identify Your Risk

Many utilities are reporting significant differences in the effects to customer demands from COVID-19. Some utilities are reporting declines in commercial sales and increases in delinquent accounts, while other utilities are not as adversely affected since they may serve as bedroom communities that are realizing an offsetting increase in residential demand from stay-at-home orders. It remains to be seen how significant of an effect the elimination of service shut-offs will be to utility revenue collections. As a result, it can be helpful to understand the utility’s customer base and exposure to industries that may be negatively affected by business closures and stay-at-home orders such as the leisure and hospitality industries. The chart below provides an attempt at categorizing risk to job loss by industry. The data shown represents national averages reported by the Bureau of Labor Statistics, but can be analyzed by metropolitan region.

Risk exposure targets potential job loss and may not correlate precisely to a change in water demand. For example, public school teachers may not be at risk of job loss, however the movement to virtual learning and the closure of public schools does result in a shift in water demands from schools to homes presumably.

Once the potential risk exposure of the utility customer base is estimated, the user charge revenue by class of customer can be identified (residential, multi-family commercial, other) and, if possible, by type of fee (i.e., fixed and variable charges), which is used when analyzing assumed changes in customer demands in Step 3.

Step 3: Adjust Revenues – Key Guidelines

Residential User Charges

Residential demands have been reported to increase due to stay-at-home orders, however it is unclear whether customer delinquencies will increase due to the elimination of service shut-offs and likelihood that some portion of the utility’s customer base may be unemployed with financial hardships. The following provides some guidelines and considerations for adjusting residential revenues:

- Estimating increases to residential delinquencies is difficult since there is little research supporting how customer behavior is affected by a stay in service shut-offs. There is some anecdotal evidence to suggest that payment delinquencies may double based on experiences of utilities that paused service shutoffs during implementation of new billing systems. Therefore, assuming a doubling or more of typical bad debt expense is reasonable.

- Estimating the increase to residential demand can be done by assuming likely increases to indoor use from stay-at-home orders. About 85% of indoor water use is related to toilet, faucet and shower use. Assuming a 5-10% increase to residential use is considered reasonable based on estimated increases to likely indoor water use categories.

- Consider reducing water demand forecasts for non-essential outdoor use, which may be lower from customers with financial hardships attempting to control/reduce their bills.

- Consider loss in revenue from seasonal customers, as travel bans continue.

- Consider reducing late payments or other field services charge revenues.

- Consider reducing growth related revenues.

Commercial User Charges

Adjustments for commercial user charges may be made based on the risks to different industries, as shared in the pie chart shown in Step 2.

- May assume no revenues from the percent of commercial accounts associated with high-risk industries due to business closures.

- For moderate risk industries, assume reducing commercial revenues by the percent that high risk commercial customers represent to the utility.

- May assume reductions to certain low risk industries such as schools, parks or other public facilities that may be closed due to COVID-19.

- While construction has not been halted completely, for planning purposes it may be prudent to assume no growth-related fees or revenues (e.g., construction hydrant meter sales) for the duration of the COVID-19 outbreak.

Other Revenue Considerations

- Revenue Projections – Evaluate deferral of adopted and/or planned rate adjustments to minimize financial impacts to customer base.

- Reclaimed Revenues – If material, identify any non-essential use of reclaimed water for irrigation purposes. Reclaimed water sales associated with cooling or data centers may continue during emergency.

- Chilled Water Revenues – If applicable, adjust based on commercial customer account and industry risk exposure.

- Wholesale Customer Revenues – These will reflect adjustments based on the customer and will generally assumed to be tied to the customers’ industry risk exposure.

- Other Miscellaneous Charges – Adjust based on type of fee for service. Any growth-related fees (such as impact/capacity fees for new development), late payments and turn-off charges should not be assumed until the utility has a plan in place to return to normal practices.

- Investment Income – Assume minimal investment income as interest rates may remain low or as reserve balances are depleted.

- FEMA Reimbursements/Other COVID-19 Assistance – Assume a delay in receipt of revenue unless receipt can be confirmed or estimated.

Step 4: Adjust Expenses – Key Guidelines

What Are Your Funding Priorities?

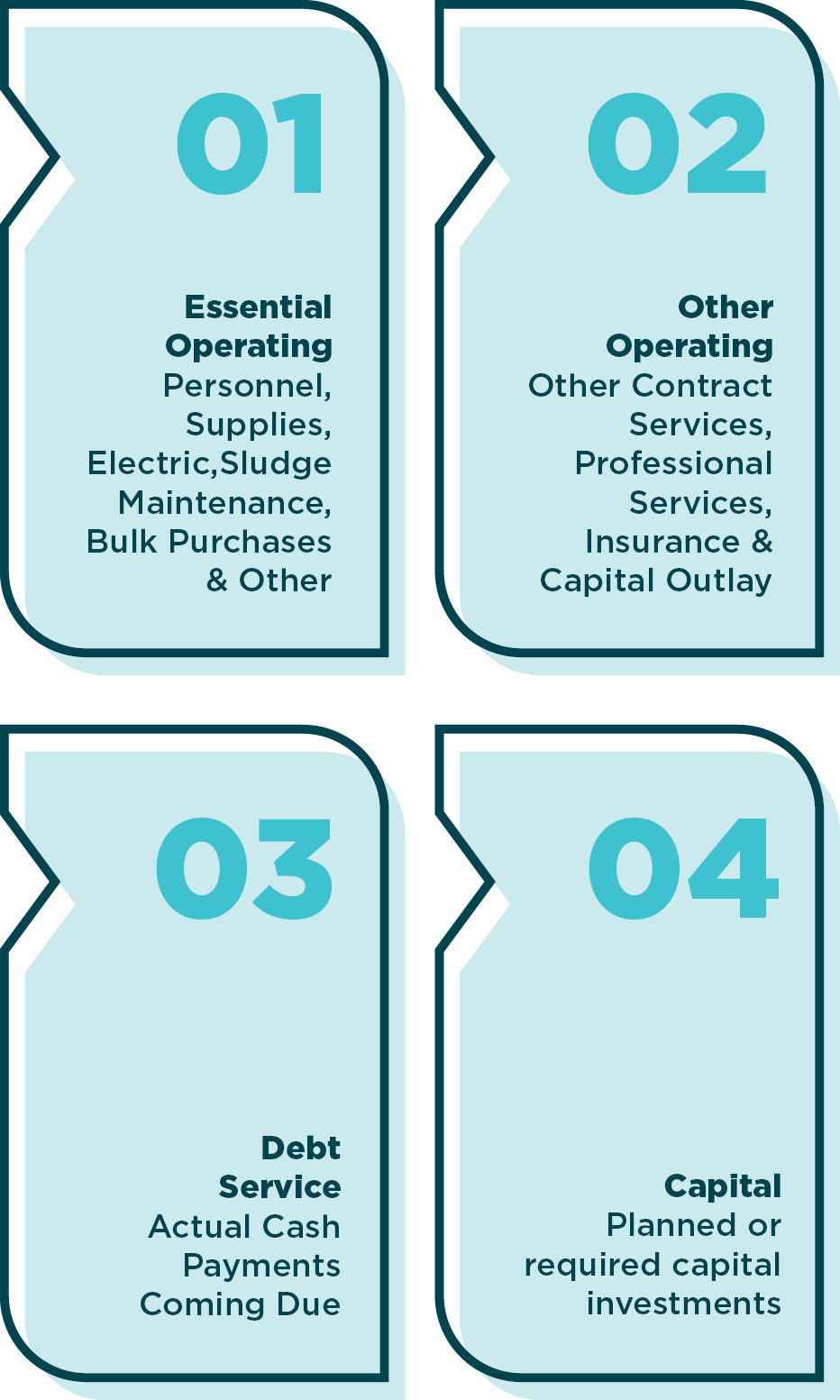

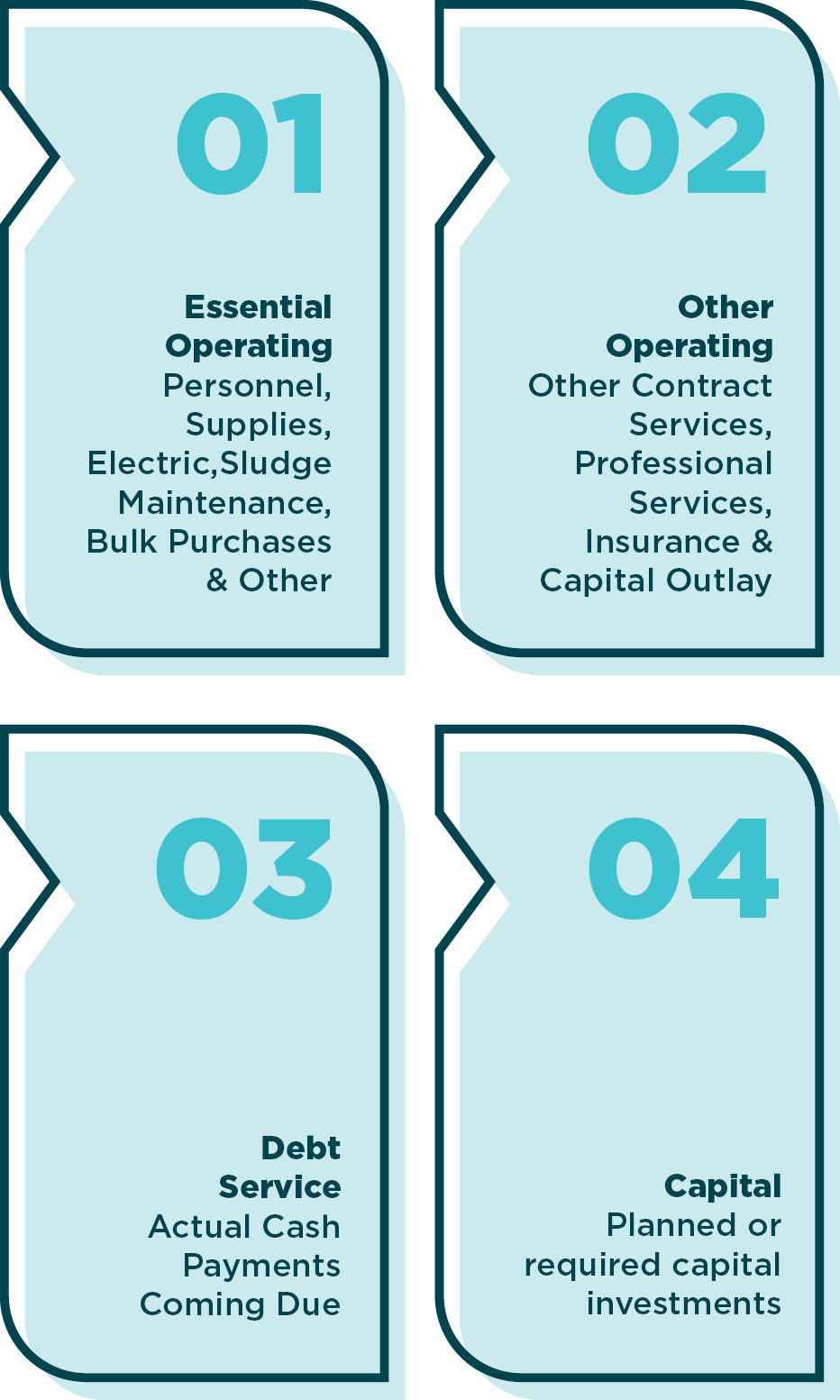

A key benefit to stress testing the fiscal position of a utility is to identify the utility’s ability to fund the following elements shown in the graphic below.

The analysis must consider the terms of any underlying loan agreement, bond resolution, or trust indenture to ensure compliance with any flow of funds provisions, minimum cash reserve requirements, debt service coverage, and/or reserve requirements.

Consider Your Essential Operating Expenses

- Personnel Expenses – Discuss any significant change in personnel expenses, such as required overtime resulting from changes in plant and field services staff that may be staggered for safety.

- Supplies – Discuss any potential risks or unit cost changes with vendors for supplies and chemicals. While Raftelis has observed no significant changes to chemical pricing to date, note that these costs are impacted by changes in energy prices and can vary with treated flows.

- Maintenance – Discuss any changes in maintenance cost impacts due to any official recommended safety guidelines during a highly infectious disease outbreak.

- Bulk Purchases – Consider any impacts to contracts for services. There could be a significant decline in billed water or treated wastewater flows if wholesale providers may be required to adjust their rates for operational continuity.

Other Expense Considerations

- Capital Outlay – Adjust for COVID-19 protocols and the nature of the capital outlay. For example, field services may be limited to line breaks to limit potential employee exposure to COVID-19 and therefore costs associated with meter replacement may not be incurred. Also, purchase of new vehicles may also be deferred due to business closures.

- Capital Costs – Most construction is considered essential and authorized to continue at this time. However, supplies of materials could be impacted due to supply chain challenges. Conditions should be monitored for any changes.

- Capital Finance – Utilities may observe interest rate volatility in the near term. Utilities anticipating the need to access capital markets should consult their financial advisor to determine the appropriate market and options, such as access to state revolving fund loans that may become more available.

- Future Impacts – Monitor potential future increases to the cost of health insurance, pension expenses and other post-employment benefits.

Takeaways

There is a lot of uncertainly and rapidly evolving conditions surrounding COVID-19. Performing a financial stress test and retooling your financial model can help you prioritize your spending, analyze your revenue variability, and determine the impact on your financial sustainability. The results can be used to inform policymakers and stakeholders, and to understand the implications for this fiscal year, as well as future fiscal years.

To learn more, see how we helped

Fairfax County and

Raleigh Water with their financial stress testing, or explore how Raftelis

can help you with financial stress testing.