A utility’s customer service policies aren’t right or wrong – instead they exist on a spectrum to encourage specific behaviors in each operating context. Customer behaviors that one utility might desire and want to encourage may differ substantially from what another utility would prefer, based on their service area, population, and target service levels. If it’s time for you to review your policies, read on—we’ve presented a range of policies related to adjustments and payment plans, as well as high-level development considerations and desired outcomes.

Generally, customers are responsible for paying for water use that occurs on their side of the water meter. Plumbing leaks and breaks on private property happen and, in some cases, without visible signs of water wastage. When this occurs without advanced metering infrastructure (AMI), the only way that a customer may learn of excessive use is through their water bill. Since some utilities bill on a bi-monthly or quarterly basis, a leak may go months without being discovered and addressed, and the customer can accrue a substantial balance. Leaky toilets can waste more than 200 gallons of water a day—6,000 gallons of water a month—without a customer necessarily recognizing the issue.

Many water utilities offer billing adjustments to customers who experience unexpectedly high water use due to a leak. The range of adjustment amounts, and the eligibility criteria vary, but adjustment policies are considered to be a customer-friendly tool that helps ensure service affordability. Adjustment policies reference the duration of time a bill will be adjusted for, the percent of overuse covered, the types of leaks covered, and how often customers are eligible to receive an adjustment.

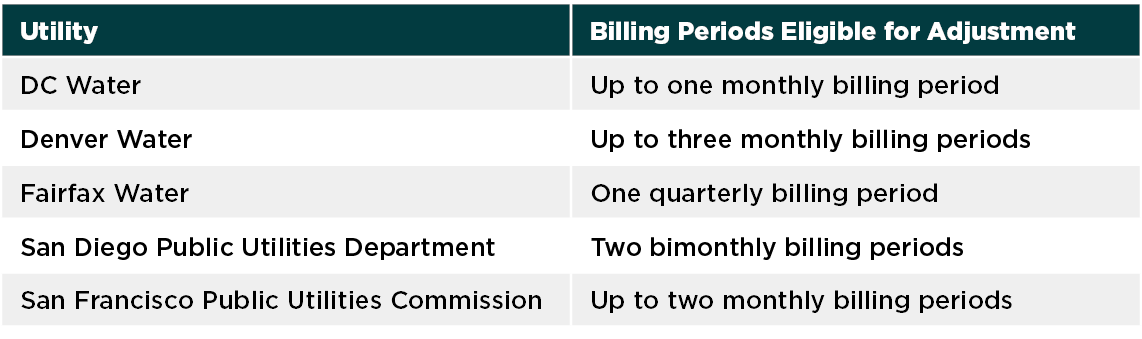

Policies vary in the number of billing periods that are eligible for adjustment for a single leak or occurrence. Utilities want to encourage wise water usage, so they limit the number of billing periods that a customer might receive an adjustment for, as this incentivizes timely repair. Utilities with AMI, which allows for much faster leak detection, also tend to limit the amount of time that a customer is eligible for an adjustment because there is no need to wait for a regular billing cycle. The table below shows the number and length of billing periods eligible for adjustment at several large water utilities.

Leak adjustment policies also vary in the type of leak and the amount of consumption that is eligible for adjustment. Types of leaks range from indoor plumbing to irrigation system leaks, with many utilities specifically calling out usage related to landscaping, filling swimming pools, etc. as either ineligible for adjustment or eligible for one-time adjustments only. Other examples of leak types and coverage include:

Our industry offers a range of frequencies that adjustments are allowable for and conditions that must be met for customers to receive adjustments. Some utilities offer unlimited adjustments while others offer adjustments every five years or more. For example, Denver Water allows for no more than two adjustments in a rolling 12-month period. Pinellas County Utilities, FL offers an unlimited number of adjustments, so long as each separate issue has been repaired and documented.

With these variations in mind, key considerations for adopting or updating leak adjustment policies include the following:

Sometimes customers may have an issue paying a utility bill on time because of financial circumstances or because a bill is unusually high. That is why many utilities allow customers to pay the balance in installments.

There are advantages to offering payment plans for both the utility and the customer. If a customer can pay a bill in installments, it reduces the likelihood that they will become delinquent and potentially risk their service being shut off. This is not only beneficial for public health, but it also saves the utility from managing the process of terminating and reinstating the customer’s service. Offering payment plans also helps utilities cultivate a reputation for being flexible and reasonable community partners.

There are disadvantages and risks associated with payment plans as well. Staff time is required to set up and track the plans to ensure compliance. Payment plans come with the risk that the utility will not be able to collect full payment, if, for example, the customer is a tenant who leaves the residence before paying the full amount owed.

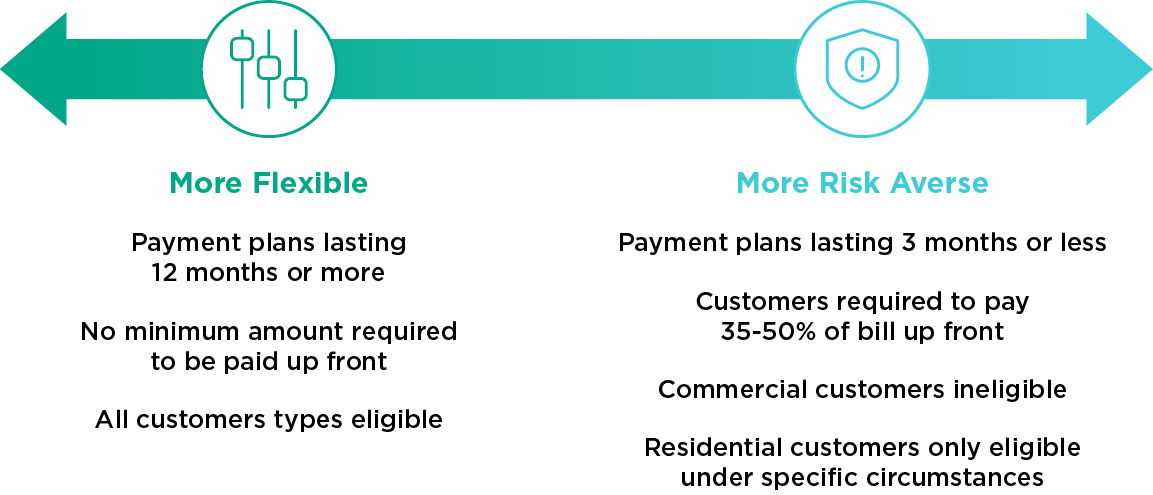

A utility can mitigate these risks by carefully considering who should be offered payment plans and for what amount and/or duration. Payment plan policies must balance risk and flexibility, and utilities choose to balance these competing priorities in different ways.

A key decision is which customer groups are eligible for payment plans. The broader the range of customers, the more flexibility a utility has to work with the customer to avoid termination of service. For that reason, many utilities opt to offer payment plans to every customer type. Others keep the policy narrow, offering plans to customers within a specific set of circumstances. Examples include:

Many utilities also differentiate between commercial and residential customers when offering payment plans. Commercial customers have higher bills, meaning that if the bill is not paid the utility risks losing significant revenue. Commercial customers may also be harder to collect from if, for example, the business shuts down before the bill is fully paid. Terminating service for a commercial customer generally does not have the same public health impact as terminating service for a residential customer. For these reasons, many utilities do not offer plans to commercial customers, or only offer them under limited circumstances.

Utilities should consider the appropriate length of a payment plan. The longer the payment plan the more likely that a customer will be able to successfully pay their balance. However, longer payment plans also require more administrative resources to track, and if a customer terminates service before the plan is complete the utility may not be able to collect the full amount owed. To address these risks, many utilities have a set cap on the length of the plans. Examples include:

In some cases, utilities must adhere to regulations concerning payment plans. For example, in California utilities must abide by the provisions of California Water Shutoff Protection Act (S.B. 998), which, among other things, requires utilities to offer some residential customers payment plan options prior to terminating service. This requirement has prompted utilities to both expand payment plan options and improve communication regarding options to customers.

Key considerations for adopting or updating leak adjustment policies include the following:

As our examples show, there is significant variation in how different utilities handle leak adjustment and payment plan policies. There is no “right” way to handle either issue. It is important for the utility’s governing body to carefully consider the opportunities and tradeoffs and issue clear policy direction based on the utility’s priorities. Other best practices for utility customer service policies include:

Adhering to these best practices, and clearly defining leak adjustment and payment plan policies, will ensure that a utility’s customer service policies are as effective a tool as possible.