Authors:

Luke Eastman (Raftelis), Erika Smull (Duke University), Lauren Patterson, PhD (Duke University), and Martin Doyle, PhD (Duke University)

Raftelis has partnered with researchers at Duke University to track the effects of COVID-19 on water utility consumption and revenues. This is an ongoing study: these are preliminary results from eight water utilities. Check back for updates as we receive more data from utilities and continue our analysis of this important topic.

May and June 2020 data for the eight water utilities in our study show diverging trends of water consumption and revenues as the COVID-19 pandemic continues, with states and local governments taking different approaches and timelines to rolling back restrictions. There are signs of recovery in water consumption and revenues for many utilities, mostly due to high residential consumption and billed revenues, not increased usage from non-residential customers. Utilities in this study have shown average to strong residential consumption and even stronger residential revenues, likely bolstered by usage associated with hot and dry summer conditions as well as inclining tier rate structures that put a premium on higher residential usage. Non-residential consumption in May and June 2020 was near or below the three-year historical average for all utilities, as were non-residential revenues.

It is now August 2020, over four months since the World Health Organization declared COVID-19 a pandemic. Utilities have already seen a variety of impacts to their operations, including extended water service shutoff moratoriums, customer assistance efforts, and changes in operations.

In June we published our first post documenting how COVID-19 has changed utility consumption and revenues for five water utilities through April 2020. We found that some utilities were experiencing changes in water consumption due to effects of the pandemic, but billed revenues were less impacted because many had increased rates over the past few years.

Since then, we have added three more water utilities and have new data from May and June to report. During this time period, the pandemic hotspots in the U.S. have shifted from the northeast to the south and southwest. States and local governments have taken varying approaches to addressing the pandemic, with some maintaining few restrictions on residents and commerce while others are ramping up restrictions to prevent the spread of the virus. These restrictions in turn influence water consumption patterns, which are of utmost importance to utility operations and finances.

Our first post included water consumption and billed revenue data from five utilities: Trabuco Canyon Water District (CA), Marana Water (AZ), Columbus Water Works (GA), Denver Water (CO), and the City of Raleigh, (NC) through April 2020. We have added three utilities to our study – they are Denton (TX), Arlington (TX), and Austin (TX). We have monthly consumption and billed revenues by customer class updated through June 2020 from each of these eight utilities.

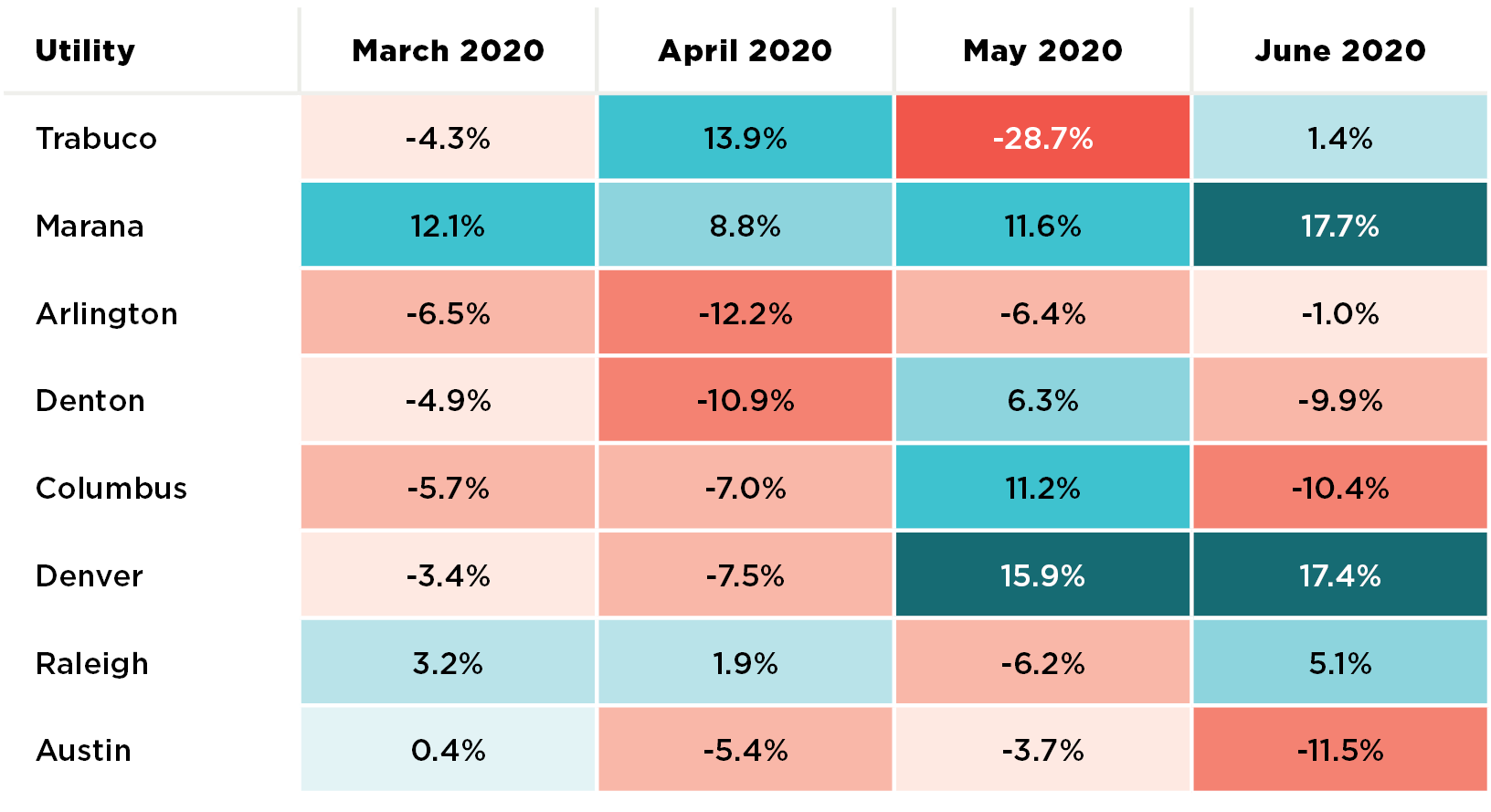

Total water consumption during the COVID-19 pandemic started off with a notably negative trend in March and April 2020, with many utilities experiencing single digit reductions in water consumption compared to the three-year average for those months (Figure 1). However, some utilities have experienced double digit increases in consumption in May or June (Marana, Columbus, and Denver). Each utility experience appears to be affected by many factors including climate and local, state, and federal policies associated with the pandemic. It is worth noting that the spring and summer of 2020 have thus far been hot and dry for many regions of the country, particularly in the west and south/southeast (U.S. Drought Monitor).

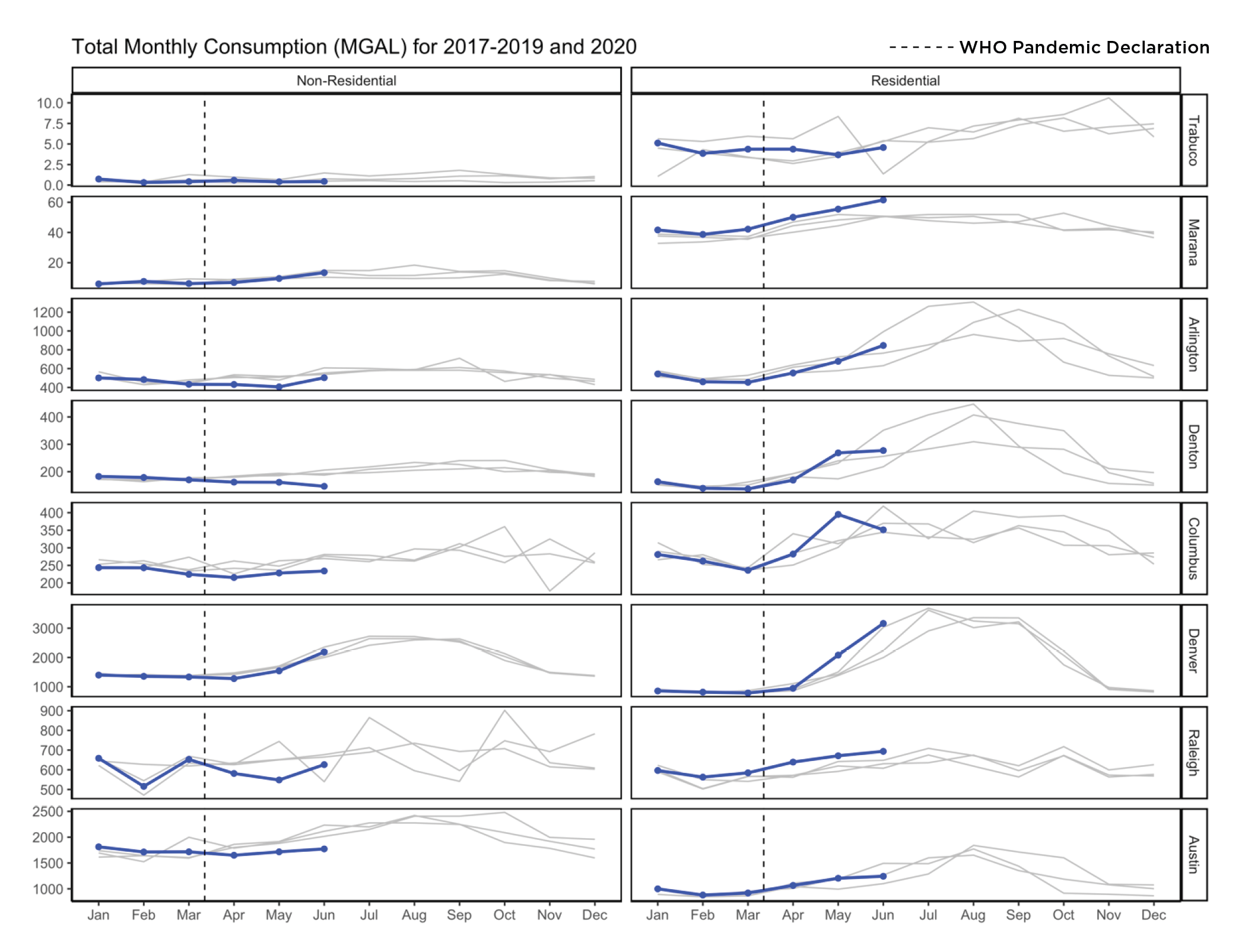

If we divide total consumption into residential and non-residential consumption we notice some distinct patterns, shown in Figure 2. Non-residential consumption was down in nearly all the utilities in the early months of the pandemic but appeared to be recovering to normal (three-year average) levels in Marana, Denver, and Raleigh by June 2020. However, no utilities experienced non-residential consumption significantly above the historical average in the most recent months.

Residential consumption patterns were similar across utilities, with many experiencing consumption within or above normal ranges, boosting revenues through the late spring and early summer. For example, May residential consumption in Denver was up 44% compared to the three-year average. These increases could be attributed to the expected shift in use from non-residential to residential due to the pandemic, as well as the hot, dry summer experienced in places like Denver and Marana, which typically boosts residential irrigation.

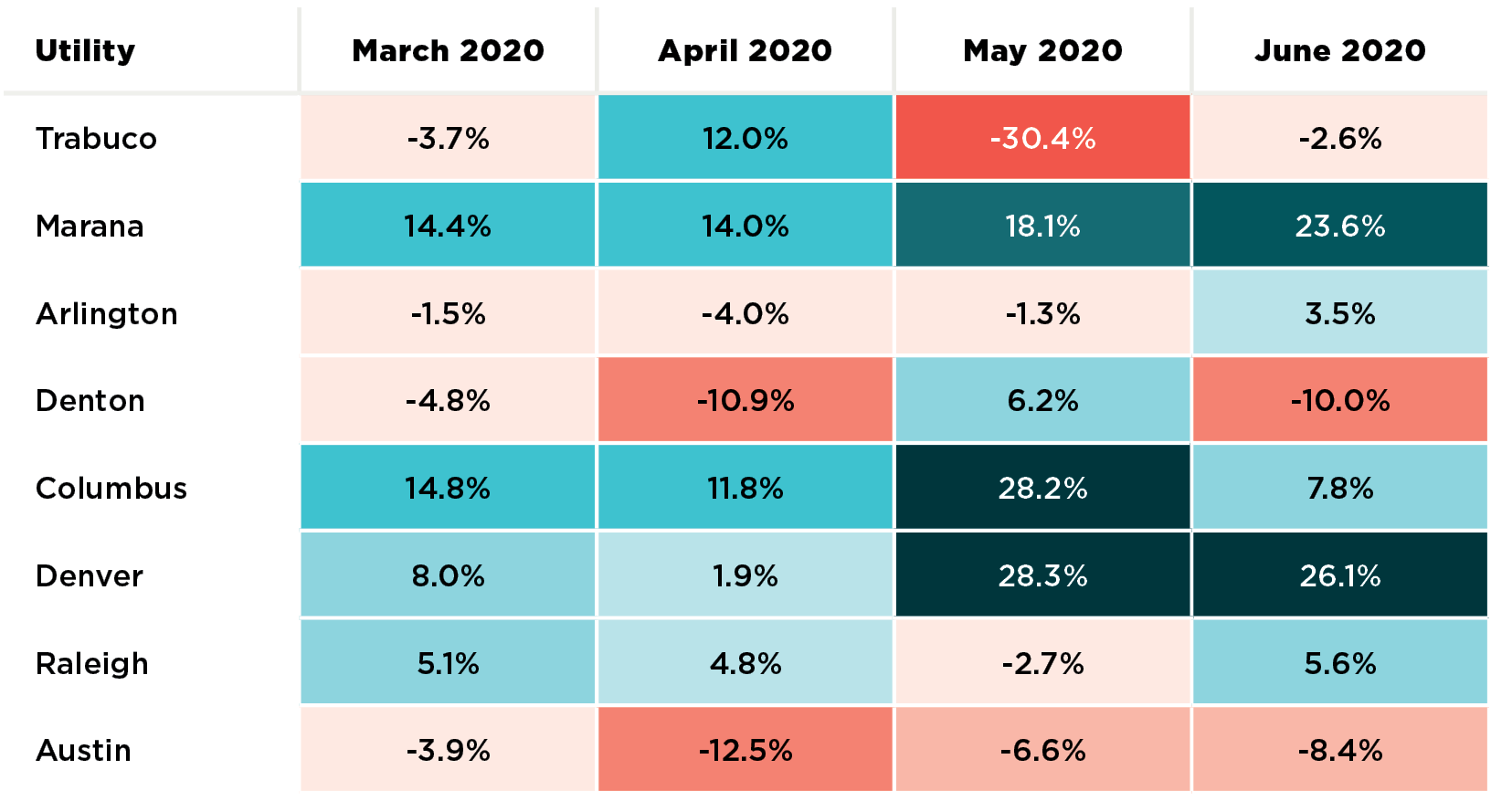

Billed revenue trends mostly mirrored consumption trends for May and June 2020 when compared to the three-year average of revenues for those months, with some cushion (lower impact) compared to consumption due to rate increases and inclining block rate structures. It is important to reiterate that revenues in our study are not receivables, and therefore do not include the impacts of non-payment or deferrals.

We calculated the percent change in 2020 total billed revenue by month compared to the three-year average (Figure 3). The emerging picture shows that some utilities (Marana, Columbus, Raleigh, and Denver) benefited from the shift in use to higher residential consumption and block rate structures that increase the price with greater water use. For example, May total billed revenue for Denver and Columbus was ~28% above average. The other utilities showed stagnant or decreasing overall billed revenues.

When billed revenues are divided into customer class, the trend of haves and have-nots becomes clearer. Non-residential billed revenues in May and June were lower or close to the three-year average for nearly all the eight utilities in our study, as seen in Figure 4. However, residential billed revenue was near or higher than the three-year average for every utility in the study except Trabuco. For example, Denver, Columbus, and Marana billed 50%, 26%, and 15% more to residential customers, respectively, in May 2020 than the three-year average for that month.

A recovery in water utility consumption and billed revenues from the early months of the COVID-19 pandemic in the U.S. can be observed in May and June 2020, but this appears mostly due to increased residential usage and revenues, which in turn could be attributed to stay-at-home orders, dry and hot summers, and inclining block rate structures. Non-residential consumption and revenues have remained near or below historical averages. Check back for updates as our research team continues to report on trends in water utility consumption and revenues during COVID-19.