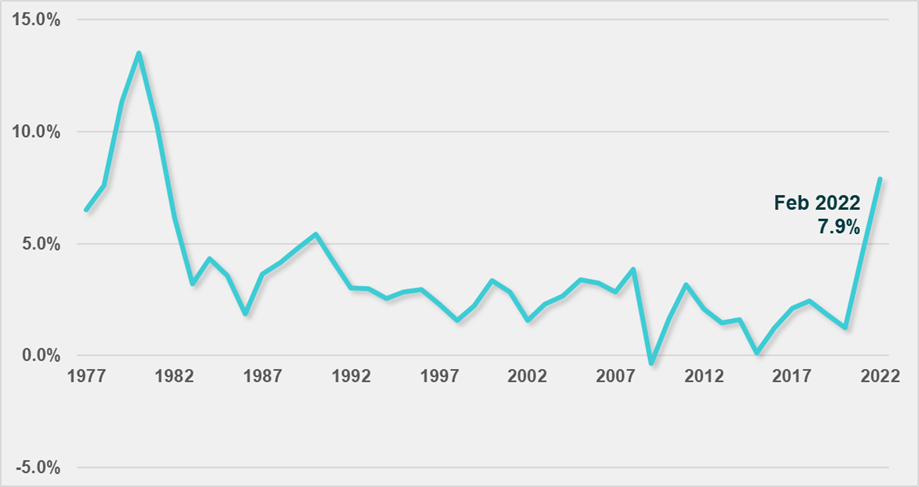

If you’ve bought gas or groceries, you know that inflation hasn’t been this high since 1982. Local governments are also feeling the pinch as they buy office supplies, vehicles, pipes, and playground equipment.

There hasn’t been much good news on this front lately. In March, the Bureau of Labor Statistics showed that inflation on goods and services was a trend that would not lessen soon. The consumer price index rose 7.9% in the last 12 months ending in February.

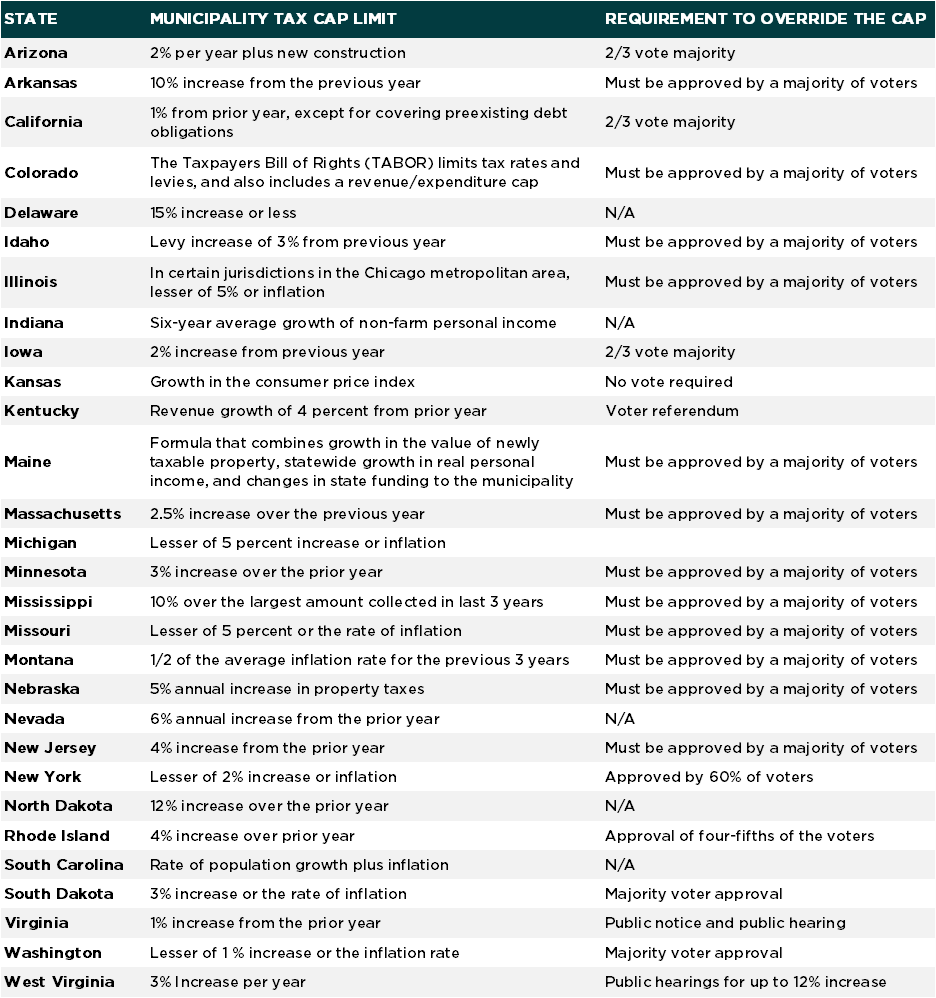

Another trend will soon hamper municipalities’ ability to manage their cash flow. Since the high inflation 1980s more than half the states in the U.S. have placed tax caps or limits on the ability of local governments to raise taxes or tax revenues over the prior year. Municipalities that fall under these limits will be challenged to deal with rising prices without the ability to increase taxes come 2023 budget time.

New York is a good example to illustrate how this works. The state has a tax cap law that limits annual tax increases to the lesser of 2% or the increase in CPI without a referendum. If municipalities in New York want to exceed the tax cap, they need approval by at least 60% of the voters in a referendum. That could be a daunting task. If you are wondering how your state compares, see the table below.

This year is also when many local governments received or will receive their share of the $65 billion in American Rescue Plan Act (ARPA) funds. That will help the budget shortfall many municipalities may face but ARPA funds are restricted in their use to four categories:

If inflation stays high at 7 to 8% as expected, it will be very difficult for municipalities to keep their budgeted spending next year below their tax cap limitations even if they can justify the use of ARPA funds to address some of the problem. Local governments will be in a tough spot as they plan for next year’s General Fund budget. The dilemma could result in either reducing expenses to stay below the tax cap limitations or holding a referendum and asking voters to approve the increase in taxes.

We’re urging the municipalities we work with to plan now for success later in the year. Local governments need to assess what path they will take to deal with the tax cap very soon. You’ll need an assessment to determine if your municipality can live with the limited tax increase allowed under the law and deal with controlling your spending or decide that you can’t abide by the tax cap.

If you are constrained by the tax cap, you’ll need to start planning for a referendum to override it. Successful referendums require getting your elected officials on board early and a significant amount of pre-planning and stakeholder outreach and communications. Referendums fail when an elected body postpones acting, staff get aren’t on consistent in telling the story of why the increase is necessary, and the overall approach is more “fingers crossed” than strategic.

If you think your municipality can cut expenses and live within the tax cap, you need to develop and implement strategies to keep spending below the tax cap. Again, strategy is important here. Since inflation is increasing at a rate not seen in more than 40 years, this is a good time to employ one-time strategies that free up additional tax cap capacity, like offloading spending that is currently funded with taxes by recovering these costs with user fees that are not covered under tax cap limitation. For example, for municipalities that have not yet implemented a stormwater user charge, this year’s high inflation presents a great opportunity to do so, with the added benefit of freeing up tax cap capacity for funding other General Fund expenses. This pre-planning and stakeholder outreach and communication as well, so to get this done by the end of the year, municipalities need to start working on these strategies now.

We’ve been helping local governments plan and implement these changes this year by:

2022 is the year that inflation and tax caps are creating a recipe for a budget crisis for many municipalities. Those that rise above the crisis will need to analyze their options, use a creative approach, and have a well-thought-out plan with several contingencies to back them up.