Water utilities have certainly not been spared, with inflationary impacts reverberating through their operating and capital budgets. To gain a better understanding of the impact of high inflation on water utilities, we analyzed results from the latest Association of Metropolitan Water Agencies’ (AMWA) INSIGHT Survey, whose participants included large water utilities from across the nation.

AMWA’s INSIGHT Survey is relatively broad. It asks questions related to operational costs, capital spending, financing, fiscal policies, rates and rate structures, and other types of miscellaneous fees and charges water utilities assess. The first survey ran in 2008. Since then, updated versions have been published once every two years, with the most recent update happening in 2022. While the most recent INSIGHT Survey was not specifically designed to analyze the impacts of inflation, several relevant questions were analyzed to get a sense for how water utilities have been impacted by rising costs in recent years.

Our analysis of the survey focused on the following five main topics, which we have further detailed below.

Since its inception, AMWA’s INSIGHT Survey has shown consistent declines in residential consumption. This is not surprising and, as we know, is in response to the installation of more efficient fixtures and appliances, conservation initiatives, and changing household demographics. However, we had a particular interest in the response related to typical residential consumption in the 2022 version of the survey, as we were curious to know if inflation, and the impact it has had on household budgets, has started to impact residential water use; and more specifically, if it has had any impact on more discretionary types of water use.

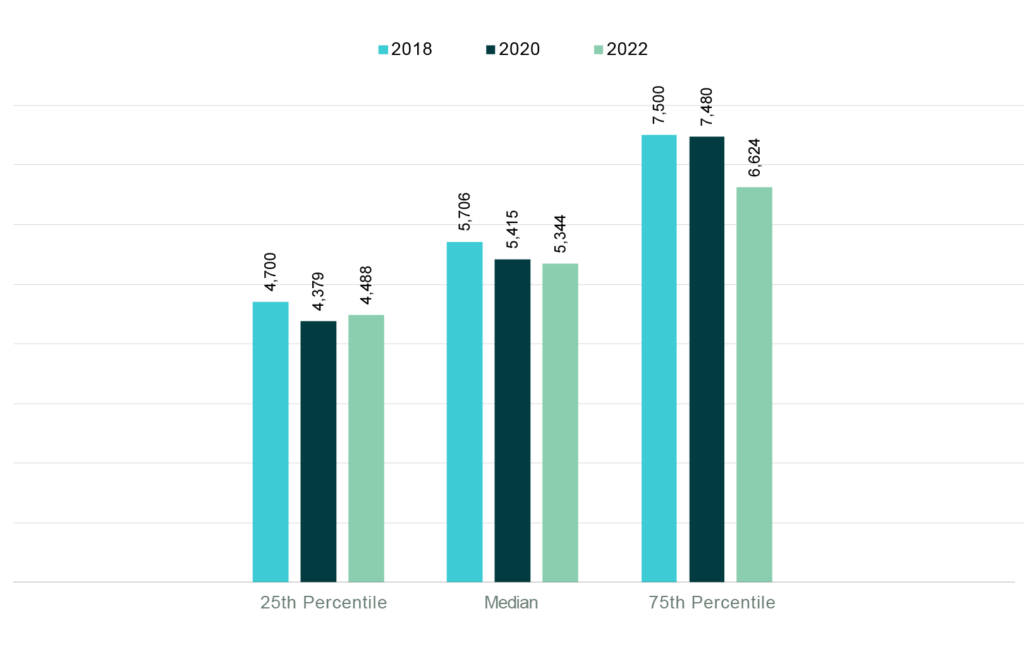

The chart below shows typical monthly residential consumption responses at the 25th percentile, median, and 75th percentile. Monthly residential consumption at the 25th percentile appears relatively stable, even rising in 2022, as compared to 2020. Residential consumption at the median continues to decline moderately, as compared to the prior survey. However, consumption at the 75th percentile tells a different story, with the 2022 results showing the largest one-year decline since the survey began in 2008 (by 856 gallons, or more than 11%).

We assume there is more discretionary water use at the higher percentiles; therefore, the chart indicates that residential customers may be starting to reduce their discretionary water use in response to inflation. This finding warrants further monitoring if the U.S. continues to experience persistently high inflation, as it could adversely impact utility revenues.

Inflation’s impact on the U.S. consumer has been well-documented by red hot CPI data in recent years. Cost increases have started to temper in recent months, leaving a trail of uncertainty about what they will do next.

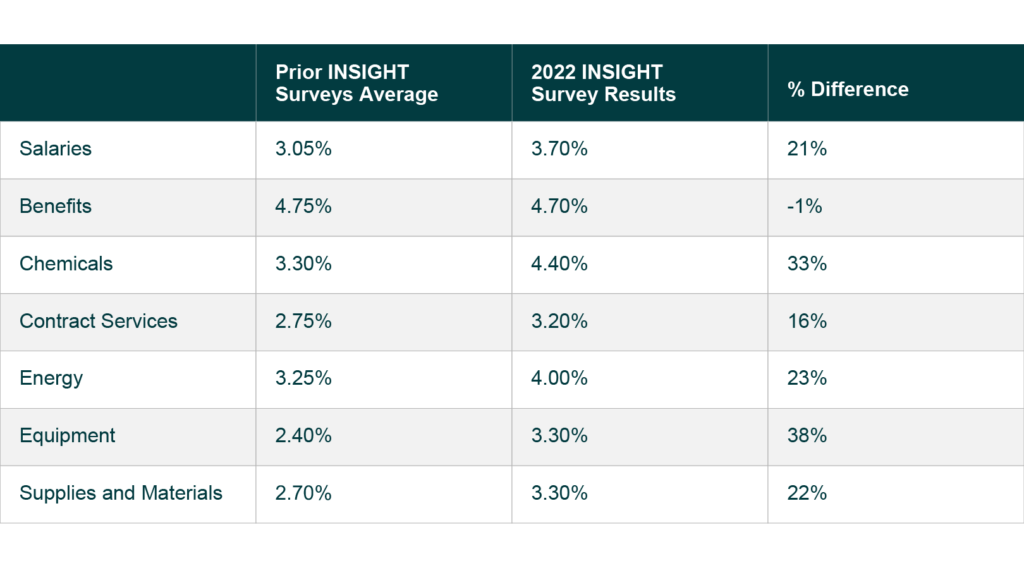

With many water utilities’ operating budgets also under pressure from rising costs, it is important to gauge the perceived impact of inflation on operating budgets going forward. Do water utility managers expect cost increases to moderate? Or do they expect them to remain at higher than normal levels?

Using historical INISGHT Survey results, we compared current and past expectations for future cost increases for common expenses. We found that respondents expect many of these costs to rise at a significantly higher rate than in prior years, with the expected annual increases anticipated to be between 16 to 38% higher than in prior years.

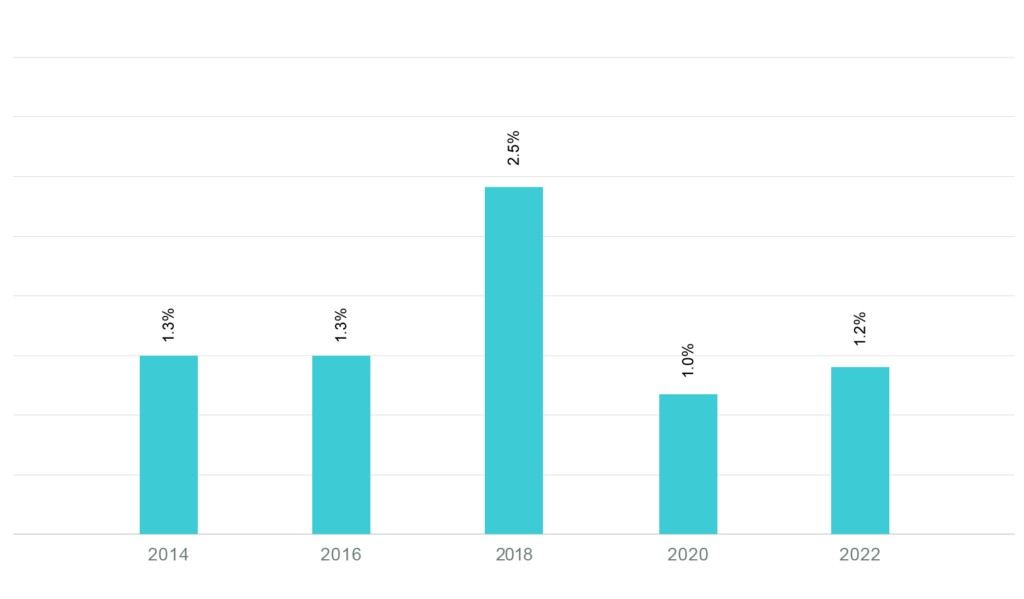

Water utilities may view capital repair and replacement projects as more discretionary than capital needs driven by regulatory requirements. Given the significant rise in the cost of many capital project inputs (labor, materials, etc.), would utilities elect to defer more routine investments into their systems to help mitigate future water rate increases? To answer this question, we reviewed historical and the most recent responses to INSIGHT’s question on planned pipe replacement projects.

Responses from the 2022 INSIGHT Survey indicated that utilities planned to replace roughly 1.2% of their distribution pipe each year over the next five years. This is quite comparable to past survey results and is in fact an increase as compared to responses from the 2020 INSIGHT Survey. This indicates that despite rising costs, utilities appear to remain committed to investing in their systems to replace aging infrastructure and to maintain and/or improve service reliability.

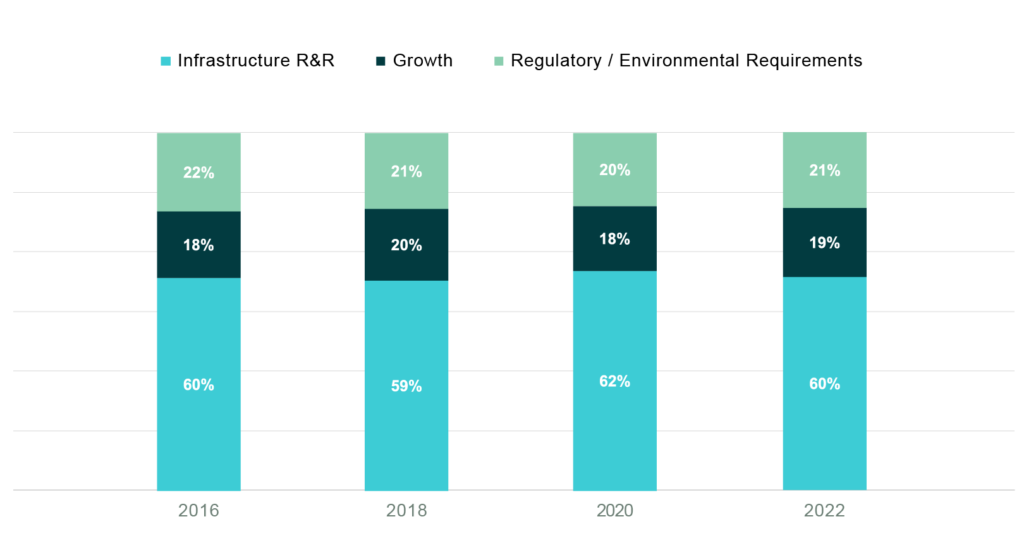

While water utilities tend to have less control over their operating costs, they usually have more discretion in their spending on certain capital expenditures, such as those for repairs and replacements, and to accommodate future growth. Have water utilities reprioritized their capital spending in response to rising costs? Are regulatory-driven capital projects comprising a higher percentage of capital spending as a result? The latest INSIGHT Survey responses breaking down the percentage of total CIP by category indicate that, for the time being, water utilities have not changed the types of capital projects they are moving forward with, with repair and replacement and growth capital still comprising the same proportion of the capital plan as they have historically. If inflation remains stubbornly high, as has been feared, it will be interesting to monitor this response in future INSIGHT Surveys.

In response to the Federal Reserve’s effort to slow inflation, the yields on municipal bonds have risen, increasing the cost of borrowing for municipal water utilities. As of October 2023, the S&P Municipal Bond Revenue Index’s yield was 4.948%, which is considerably higher than the average cost of money indicated by responses to the 2022 INSIGHT Survey (3.2%). With questions about if rates will need to remain “higher for longer,” we looked to the INSIGHT Survey to give us a sense of the water sector’s potential capacity to continue to use debt, but at higher interest rates.

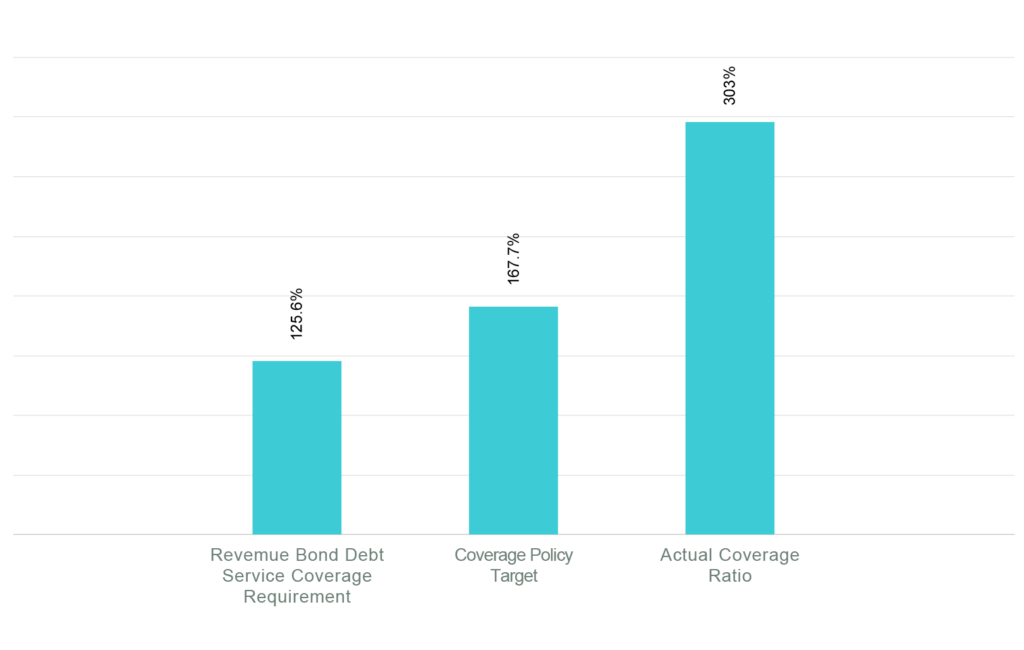

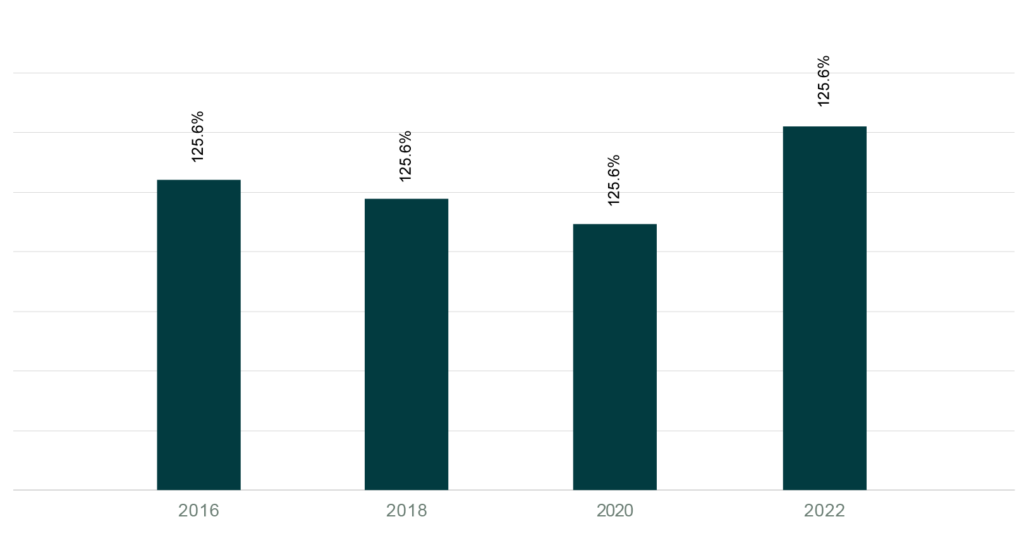

The results indicated that utilities remain in good standing on their debt metrics. Policy targets for debt service coverage were shown to exceed their coverage requirements by about 33% (167% versus 125%) and actual coverage levels for respondents were almost double their policy targets.

In the next several years, customer bills will likely be impacted by rising utility operating expenses, continued pressure on capital project inputs, and higher interest rates. To what extent will those bills be impacted?

According to INSIGHT Survey responses related to projected rate increases, on average, utilities are projecting to increase rates by almost 5% per year over the next five years. This increase is 37% higher than the expected future increases reported in the 2020 survey (4.94% compared to 3.6%) and 25% higher than expected future increases reported in the 2018 survey (4.94% compared to 3.94%), indicating that while future expected rate increases are anticipated to be on average fairly moderate, these increases are also anticipated to be higher than in previous years.

The INSIGHT Survey is a great tool that water utility managers can use to analyze industry trends or to see how the latest challenges facing the industry, such as those related to cost inflation, are affecting utilities. Utilities that are members of AMWA and participate in the survey can access the INSIGHT Dashboard. The dashboard is an easy-to-use, web-based tool that can be used to analyze trends over time, sort by region or comparable utility size, incorporate useful “normalizers” to allow for easy comparisons among utilities of all sizes, and more. Learn more about AMWA INSIGHT

Recent webinars providing summary results of the 2022 version of the INSIGHT Survey and a deeper dive into survey results with accompanying analysis were held in early 2023 and can be viewed here.